A common refrain is that drug prices are too high. The question is, which price? List prices–i.e., the sticker price–almost no one pays. Patient copayments are set by health plan generosity and often are loosely correlated with the price a health plan pays. Any what does the health plan pay?

To simplify, health plans pay the list price, but then negotiate rebates from manufacturers in exchange for volume (i.e., sales) or generous formulary placement. A white paper by ICER provides a nice historical overview:

Prior to 1996, manufacturers offered discounts to health plans for their drugs, while charging an undiscounted list price to wholesalers and pharmacies. Wholesalers would then bill the manufacturer for the difference between the amount they purchased the drug for from the drug manufacturer, and the amount they were reimbursed for the drug, as determined by the discounted rate negotiated by the health plan. This was known as a chargeback. Pharmacies, however, had no direct relationship with drug manufacturers and could not negotiate similar discounts, or chargebacks.

After a class action law was brought by the pharmacies, manufacturers could no longer discriminate against pharmacies. However, a 1996 law gave safe harbor to drug manufacturers to the Anti-Kickback Statue to allow them to pay rebates to health plans.

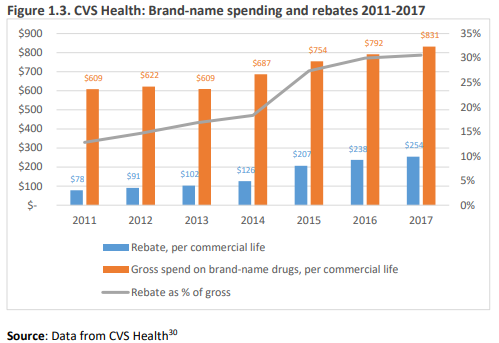

And boy have rebates grown over time. The ICER report uses data from CVS and shows that rebates as a percentage of list price have grown from 13% in 2011 to 30% in 2017. Large list prices may mean higher out-of-pocket costs for consumers, particularly those with large deductibles or cost sharing mechanisms.

How rebates work does vary across payers in the U.S. Medicaid, for instance, receives either the lower of either a minimum 23.1% rebate off the average manufacturer price (AMP) for branded drugs or the “best price” offered to any other payer–public or private. State Medicaid Agencies can negotiate even steeper rebates in additional to the federal minimums. Why would manufacturers accept such steep rebates? Well, manufacturers who do not sell drugs to Medicaid are excluded from selling the same drug to Medicare by law. In Medicare Part D, the government and beneficiaries pay premiums for drugs, but the drug coverage is actually administered by private insurers. These private plans negotiate rebates with manufacturers without government involvement, but rebates accrued must be reported and paid to the government. Rebates in Medicare Part D are typically higher than individuals with commercial insurance. For private health plans, pharmacy benefit managers (PBMs) often negotiate rebates for private payers, and PBM reimbursement typically comes as a percentage of these rebates. Thus, PBMs prefer that drug list prices stay high so they can negotiate large rebates. However, some payers are requiring PBMs to pass through all rebates and instead PBMs would be paid directly by the health plans.

A survey report from the Pharmacy Benefit Management Institute (PBMI) reported that just under half of employer respondents said they received 100% of rebates (either with a minimum rebate guarantee [27%] or without [22%]), a significantly higher percentage than similar estimates from 2014.

Interestingly, based on an ICER survey, pharmaceutical firms were more likely to support transparency (only 14% preferred confidential pricing) whereas most PBMs prefer confidentiality (66%)

That’s a very instructive graph. While CVS had a net increase in spending on brand-name drugs of 8% over 7 years, the AWP of the brand-name drugs they bought went up 36%. The white paper is also very interesting. A lot of caution advised about making changes, but the upshot seems to be although it’s not clear what the result of change would be, transparency, point-of-sale discounting, and 100% pass-through to plans combined may not be unreasonable to consider. Drug companies are obviously not happy at being targeted for high prices when they have to give deep discounts to PBMs–no wonder they are more in favor of transparency. Nobody is eager to take the fall for patients’ increased out-of-pocket costs.