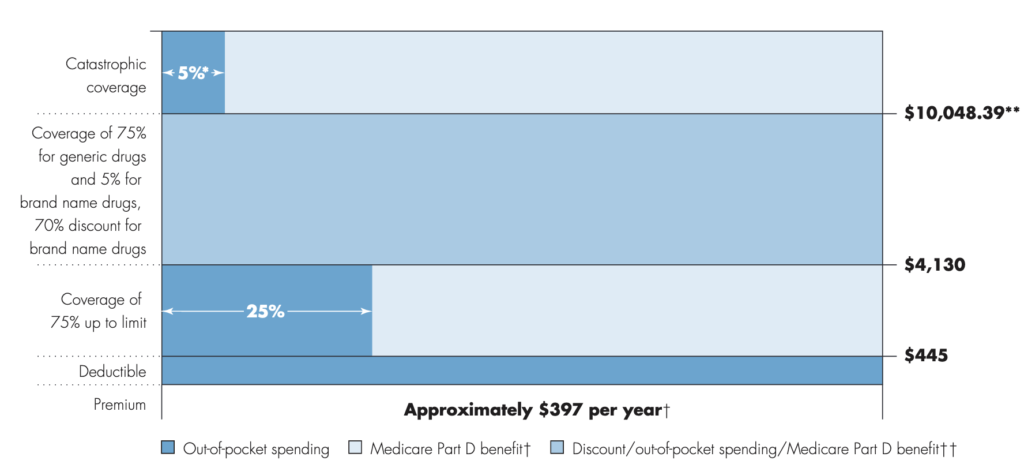

If you are on Medicare, how much will you pay for insulin? The answer is in the graph below (via MedPAC’s Payment Basics)

Seem confusing? Well it is. Medicare Part D beneficiaries have a deductible, then the standard coverage phase with 25% cost sharing, then a coverage gap where beneficiaries pay 25% of cost (manufacturers cover 70% of the cost for branded drugs in this coverage gap), and then a catastrophic phase where beneficiaries pay 5%. Wouldn’t it be easier if there were simple copayments like many commercial plans?

That is what CMS has been trying out in their Part D Senior Savings Model. The model includes fixed copayments for certain enhanced Part D plans. CMS writes:

The voluntary Model tests the impact of offering beneficiaries an increased choice of enhanced alternative Part D plan options that offer lower out-of-pocket costs for insulin. CMS is testing a change to the Manufacturer Coverage Gap Discount Program (the “discount program”) to allow Part D sponsors, through eligible enhanced alternative plans, to offer a Part D benefit design that includes predictable copays in the deductible, initial coverage, and coverage gap phases by offering supplemental benefits that apply after manufacturers provide a discounted price for a broad range of insulins included in the Model.

As described by former CMS administrator Seema Verma in the Health Affairs blog:

MS’s Part D Senior Savings Model is designed to lower prescription drug costs by providing Medicare patients with Part D plans that offer the broad set of insulins that beneficiaries use at a stable, affordable, and predictable cost of no more than $35 for a 30-day supply…beneficiaries who do not qualify for the low-income subsidy (LIS) currently pay 5 percent of the negotiated price when they reach the catastrophic phase, which should be lower than $35 in most cases. Part D sponsors could offer lower copays than $35 and still maintain all formulary flexibilities and choices.

Sharon Jhawar, Chief Pharmacy Officer at the SCAN Health Plan argues that the Senior Savings Model is working, should be made permanent, and should be expanded to both other diabetes medications and medications used to treat other common chronic conditions. Previous research shows that cost is a barrier to medication adherence, and she writes:

Let’s accelerate the timeline for making the Model permanent and use the expected cost-savings ($250 million per year) to advance other health initiatives for Medicare beneficiaries with diabetes…Yet diabetes is only the fifth most common chronic condition among Medicare beneficiaries. People with other chronic conditions, such as heart conditions, neurological conditions, or auto-immune diseases, will encounter the same financial challenges we see in the diabetes medication scenario. With a successful template in place to manage costs, we have a unique opportunity to reduce prescription costs across the board.

For more information, read the CMS Senior Savings Program Fact Sheet and visit their website.