Most people think that the Affordable Care Act (ACA) has focused on decreasing uninsurance rates by creating health insurance exchanges, providing subsidies for health insurance premiums for these exchanges, and expanding Medicaid. The ACA also has affected a number of other segments of the health care industry.

Less well known is that the ACA also affected the 156 million Americans insured through an employer-sponsored plan. Drawing largely from a policy brief from the UC Berkeley Labor Center, I summarize the affect of the ACA on employer-sponsored plans.

- Employer participation in marketplace: Firm Size. Small employers can participate in the Marketplaces. States have the option to define small employers as up to 50 or 100 employees through 2015, and must define small employers as up to 100 employees beginning in 2016.

- Is marketplace participation mandatory for employers? No. Employers of all sizes may also continue to purchase coverage outside of the Marketplaces.

- Subsidies:

- For patients. For purposes of determining eligibility for subsidies through the Markplaces, affordable employer-sponsored insurance is defined as requiring an employee contribution of less than 9.5 percent of household income for an employee-only plan that covers at least 60 percent of medical costs on average (“minimum value”). If self-only coverage costs less than 9.5 percent of household income and the employer offers family coverage (at any cost), then both employees and their family members are ineligible for subsidies regardless of whether or not family coverage is affordable.

- For firms. Tax credits are available for small businesses with 25 full-time equivalent employees or fewer and average wages of no more than $50,000. The credit pays up to 50 percent of employer contributions beginning in 2014. However, the credit is only available for employers that purchase coverage through the exchanges.

- Penalties for firms failing to cover workers.

- Firms not offering coverage: Applicable large employers not offering coverage or offering coverage to fewer than 95 percent of its full-time employees pay $2,000 multiplied by the total number of full-time employees minus 30. This penalty only applies if at least one full-time employee receives subsidies in the Marketplaces.

- Firms offering coverage: Applicable large employers offering coverage to at least 95 percent of its full-time employees pay the lesser of $3,000 multiplied by the number of full-time employees receiving subsidies, and $2,000 multiplied by the total number of full-time employees minus 30. This penalty may occur because employers did not offer coverage to a full-time employee or because the coverage offered was unaffordable or did not provide minimum value.

- Automatic Enrollment. Employers with more than 200 full-time employees must automatically enroll employees into a plan unless they opt out of coverage.

- Maximum waiting period. Group health plans and issuers offering group health insurance must limit waiting periods for coverage to no more than 90 calendar days (including weekends and holidays) effective in 2014.

- Grandfathering. ACA establishes new standards for employer-sponsored plans, but plans in existence as of March 2010 are grandfathered with regard to many of the standards for current employees, their family members and new employees

- Cadillac Tax. Insurers will be taxed at 40 percent of the aggregate value of plans above a high-cost threshold beginning in 2018. In the case of self-insured plans, the tax will be paid by plan administrators. The cost of this tax will likely be passed on to employers and enrollees through higher premiums. In 2018, the high-cost thresholds will be $10,200 for individual coverage and $27,500 for family coverage.

- Flexible spending account: Contributions to a Flexible Spending Arrangement (FSA) for medical expenses are limited to $2,500.

- Reporting Requirements. Employers must report the value of the benefits on each employee’s annual Form W-2 beginning with the calendar year 2012 forms.

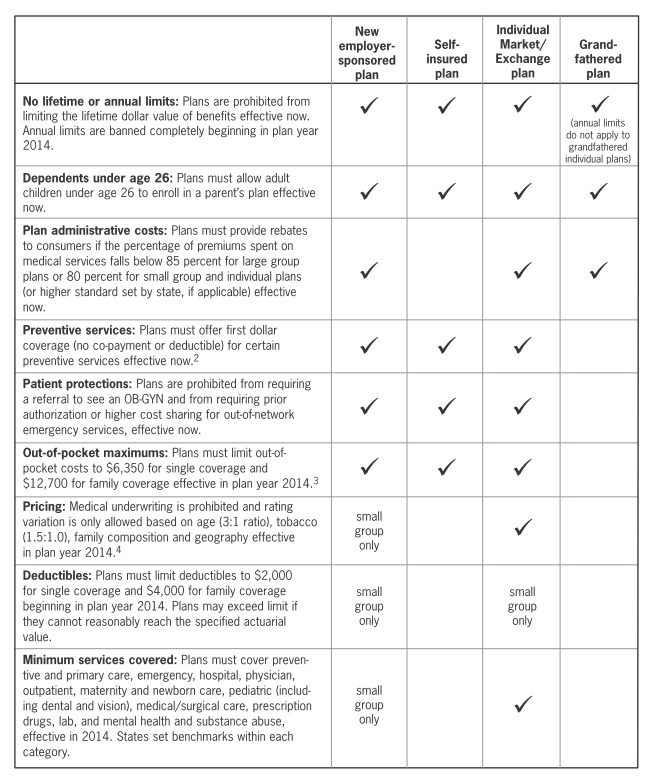

- Health Plan Standards: See table below

Source:

- UC Berkely Labor Center. Affordable Care Act: Summary of Provisions Affecting Employer-Sponsored Insurance. June 2014.