Let’s say you go to an in-network provider. If you have fairly generous health insurance (i.e., not a high-deductible health plan), one would expect the cost sharing to be fairly modest. That is not always the case. You may be charged out-of-network cost sharing rates through no fault of your own. In a report by Adler et al. (2019), the authors define surprise billing as:

Surprise out-of-network medical bills occur when patients are treated by providers outside their health plan’s contracted network under circumstances that cannot reasonably be avoided. Usually, surprise bills happen when patients are treated by an out-of-network provider that they did not choose. For example, patients undergoing surgery at an in-network hospital performed by an in-network surgeon (of their choosing) may be surprised to learn after the fact that their anesthesiologist (who they did not choose) was out-of-network.

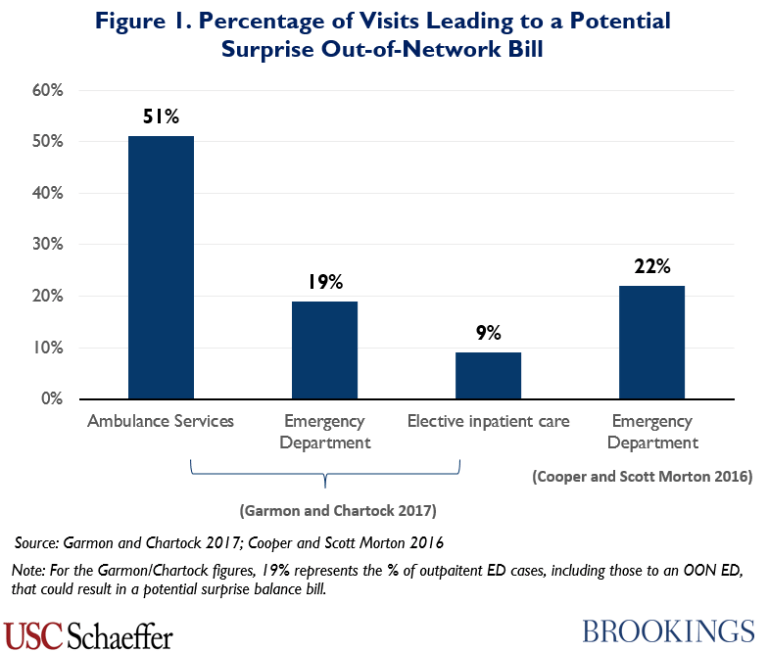

Where do these surprise out-of-network bills typically occur? The report identifies three key areas: ambulance services, emergency department and elective inpatient care.

One approach the authors recommend is to have centralized price regulation. Namely, require out-of-network rates to be no more than 125% of Medicare rates. Another approach would bar independent billing. In other words, if you got services at a hospital, the hospital would have to bill you at in-network-rates; any contracting out to out-of-network providers the facility provider would be responsible for. These approaches would work well, but may not be flexible enough to accomodate different market structures and pricing arrangements. Regardless, more price transparency is needed on all sides.