One of the challenges of single payer systems is that individuals do not have a choice of insurance. If you don’t like the single-payer plan, too bad. Free marketers would argue that in the commercially insured market, threat of competition ‘insures’ (pun intended) that health insurers are efficient and not funding fraud, waste and abuse. But how much choice is there in practice in the U.S. private health insurance markets?

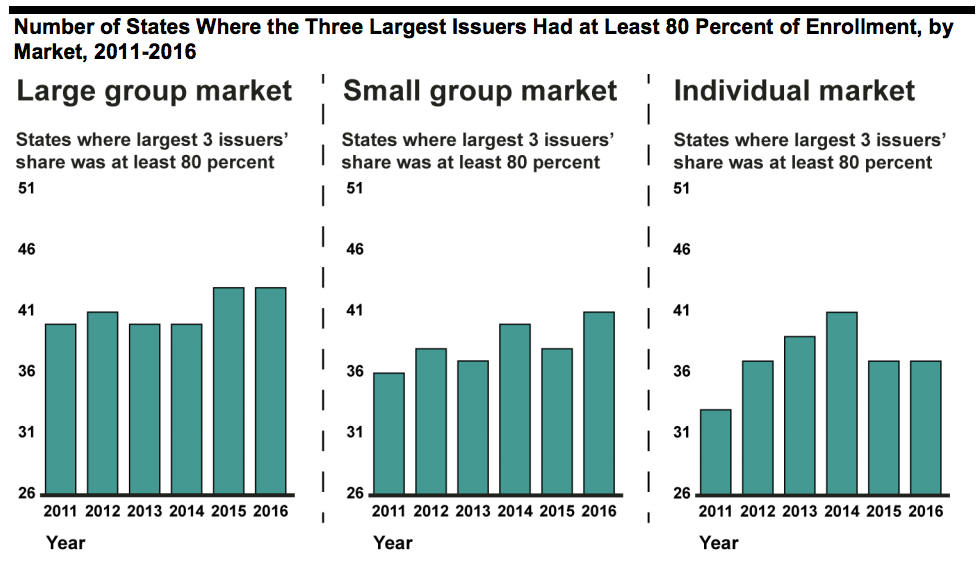

A March 2019 Government Accountability Office (GAO) report found the answer is that in most states, 3 insurers control most of the market.

On average, there were 16 issuers participating in each state in 2016. However, that same year, the 3 largest issuers cumulatively held 80 percent or more of the market—an indicator of high concentration—in 37 of 51 states…The remaining issuers in each state often had significantly smaller market shares—on average, 12 of the 16 issuers in each state held less than 5 percent market share.

Let’s take the case of the state where I grew up, Wisconsin:

…in Wisconsin in 2017, the market share of the three largest issuers ranged from 75 percent in 2 of the state’s 16 rating areas to 100 percent in 6 rating areas; on average, the three largest issuers held 92 percent market share across the 16 rating areas.

In practice, however, there is not a single private health insurance market. Insurance is divided into large group plans (typically business with 50 or more employees), small group plans (businesses with less than 50 employees) and individual plans (you buying insurance from health plans directly). Still, GAO reports similar trends across the insurance types; choice is there but limited.

Single payer supporters will take these data to mean that going from the current system to a single payer is not that big a leap. That would be an incorrect inference. Even if market share is fairly concentrated, there is still some choice. Further, even if choice is limited, the treat of entry from other health plans does provide some competitive discipline.

Market share is not necessarily an indicator of choice. Most individuals have no choice about their private health insurance since the vast majority receive their insurance from their employers (89% in 2016 according to the CBO). Their benefits office might change insurer, but as an individual, they have little to say in the matter. There is also very little transparency in the insurance market. They may cover a percentage of the lowest of actual, usual and reasonable charges, with deductibles, that vary by a number of criteria. But if you ask what your cost for a particular procedure will be, the answer is often, “wait for the explanation of benefits.” Single-payer plans have the potential for much greater transparency and predictability. That’s why a lot of people are very happy with Medicare.