Medicare beneficiaries are largely elderly individuals, many of whom suffer from a variety of health conditions. Pharmaceutical manufacturers want these patients and their physicians to be aware of new medical treatments that become available (i.e., new approvals) as well as new uses for existing drugs (i.e., new FDA indications). Direct-to-consumer advertising (DTCA) is one way that pharmaceutical firms make consumers aware of these new treatments. Drug company spending on DTCA increased significantly in recent years, from $1 billion in 1997 to $6 billion in 2016.

The Government Accountability Office (GAO) provides some details on drug advertising in their 2021 report Medicare Spending on Drugs with Direct-to-Consumer Advertising. The report answers 3 questions:

(i) how much did drug manufacturers spend on DTCA for prescription drugs? (ii) how much did Medicare spend on prescription drugs that used DTCA? and (iii) how did drug manufacturer DTCA spending, Medicare spending, and Medicare use for selected drugs change over the last decade? A few highlights:

Drug manufacturers spent $17.8 billion on direct-to-consumer advertising (DTCA) for 553 drugs from 2016 through 2018…Almost half of this spending was for three therapeutic categories of drugs that treat chronic medical conditions, such as arthritis, diabetes, and depression. GAO also found that nearly all DTCA spending was on brand-name drugs, with about two-thirds concentrated on 39 drugs…

…drug television advertising comprised about 76 percent of total DTCA spending ($13.4 billion of the $17.8 billion)…This share was followed by spending on magazine advertisements ($3.6 billion), digital advertisements ($603 million), and advertisements in other types of media, such as newspapers and movie theaters ($113 million).

Data on DTCA spending came from Nielsen Media and information on each drug (e.g., approval year, indication, brand vs. generic, biologic vs. small molecule) came from FDA approvals.

DTCA spending between 2016 and 2018 was highest for Humira, at $1.4 billion. Spending for neuropathic pain drug Lyrica was $913 million and spending for type 2 diabetes biologic Trulicity was $655 million.

The report also finds that Medicare and its beneficiaries spent $324 billion on prescription drugs that were advertised (58% of Medicare drug spending) compared to $236 billion (42%) on drugs that did not have any DTCA expenditures.

Unsurprisingly, DTCA advertising rose when a drug received a new indication and fell when generic competitors entered the market. In fact the GAO reports:

While these examples illustrate how consumer advertising may contribute to increased Medicare use, events such as FDA approval for additional indications, would likely have led to increases in drug use on their own (i.e., without consumer advertising).

A key question is, did increased advertising lead to increased use of these medications? The answer is almost certainly yes (why would drug companies advertise if they didn’t work?), but it isn’t the only or likely even the primary factor.

Beyond DTCA spending, stakeholders we interviewed cited a number of other factors that likely contribute to the overall use of drugs and drug spending, including in Medicare. These factors included doctors’ prescribing decisions, health plan formulary controls, a drug’s therapeutic benefit, and manufacturer spending on drug promotions directed to doctors. Some stakeholders said that, in their view, DTCA spending likely contributes less to overall drug use and spending compared to these other factors. For example, several stakeholders explained that while DTCA may encourage and help consumers to have informed conversations about their medical conditions and treatment options with health care providers, it is the provider’s judgment about the medical condition and therapeutic benefit of that drug that ultimately determines if the drug is prescribed to the patient

Additionally, there is some reverse causality to consider as well. DTCA spending is likely not allocated randomly across drugs. Blockbuster breakthroughs like Humira (for immunologic conditions) and Keytruda (to treat a variety of cancers) are much more likely to have high DTCA spending in large part because they represented a large clinical improvements over the previous standard of care. Drugs that offer only marginal clinical benefits are likely to have much lower DTCA.

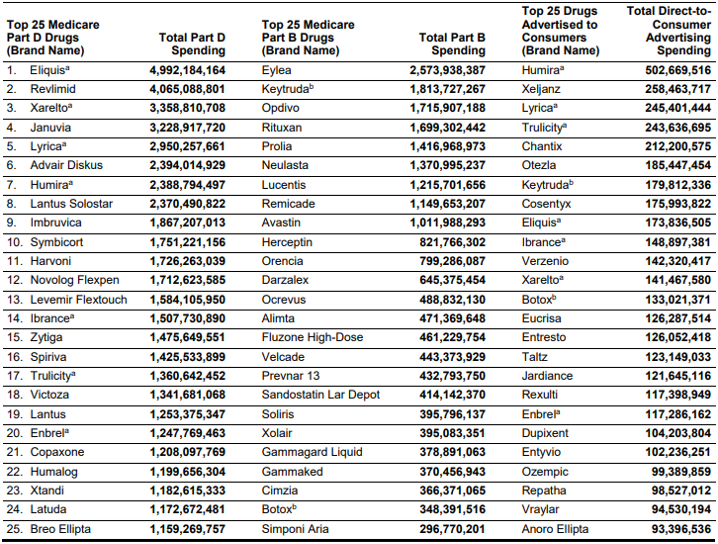

Below are the top drugs in terms of Part B, Part D and DTCA spending.