That is the question that a recent JAMA study–Mulcahy et al. (2021)–aim to answer. The authors use IQVIA MIDAS data to estimate sales price and volume in the US. These can can be used to estimate drug wholesale acquisition cost (WAC), but they ignore rebates. To account for rebates in the US they use SSR Health information Then international prices are identified based on the IQVIA MIDAS data across 6 markets (Australia, Canada, France, Germany, Japan, and the U.K). The authors then calculate US wholesale prices, US net prices and what US prices would be if drugs were reference priced to these 6 markets. Based on this approach, they find that:

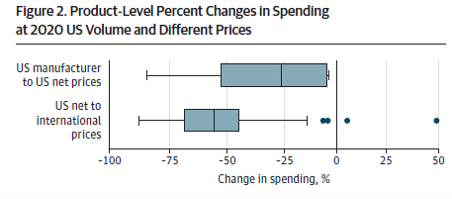

International reference pricing would have lowered 2020 US spending on study products by 52.3% or $83.5 billion, from $159.9 billion at US net prices to $76.3 billion…US net-to-international discounts ranged from 44.4% to 57.3% across therapeutic classes

So if reference prices were enacted as proposed in H.R. 3, could we expect a 50% decrease in prices in the US? The answer is ‘no’. The reason for this is that the Mulcahy et al. paper examines the impact of reference prices in a static rather than a dynamic setting.

As noted in a recent Commonwealth Report, pharmaceutical firms are likely to alter their pricing strategies if reference pricing were adopted in the U.S. They may not accept lower prices in reference-priced countries or may delay entry in these markets.

The countries included in the reference basket may also respond as well. As the Commonwealth Fund report states:

…each of the six countries listed in H.R. 3 would have incentives to allow manufacturers to exclude rebates and other price concessions from the (high) prices reported for incorporation into the AIM [average international market] price. The six countries would each benefit by concealing the much lower net prices they would actually pay. In addition to being in their national interest, such rules also would benefit manufacturers and limit drug savings in the U.S. by increasing reported AIM and target prices.

Also, launch prices may be higher as well. Title II of H.R. 3 would impose rebates to offset prices that increase faster than inflation. To insure the net present value of a drug’s revenue of it’s lifetime remains similar, it is likely that pharmaceutical firms would pursue high launch prices, if prices are highly constrained over time.

In short, reference pricing is likely to lead to lower prices in the U.S. (but not as much as expected by

Mulcahy and co-authors), higher prices and delays in access for countries in the reference basket, and also the potential for fewer drug launches in the future if returns to life science R&D decrease (see an August 2021 CBO report). There is no free lunch.