A Health Affiairs Forefront article by DiGiorgio (2023) argues the 340B has outlived its purposes. He writes:

By mandating that drug companies give a large discount to covered entities, the majority of which are hospitals with disproportionate share or critical access designations, the 340B program was intended to provide a financial buffer for institutions such as the one where I work. However, the 340B program has become gamed by large corporations to increase revenue. It is no longer serving its original intent.

The program has grown rapidly among hospitals that serve wealthier patient populations. 340B hospitals are expanding into more affluent neighborhoods, and they are mindful of payer mix as they move into areas with fewer publicly insured patients. 340B institutions are more likely to avoid counties with lower income levels and more uninsured patients. While Rep. Waxman argues that these revenues are being used to increase service lines for low-income patients, the evidence suggest that 340B hospitals did not increase care for underserved populations or increase their rates of uncompensated care. There are many reforms that could preserve safety-net funding while curbing abuses of the 340B system

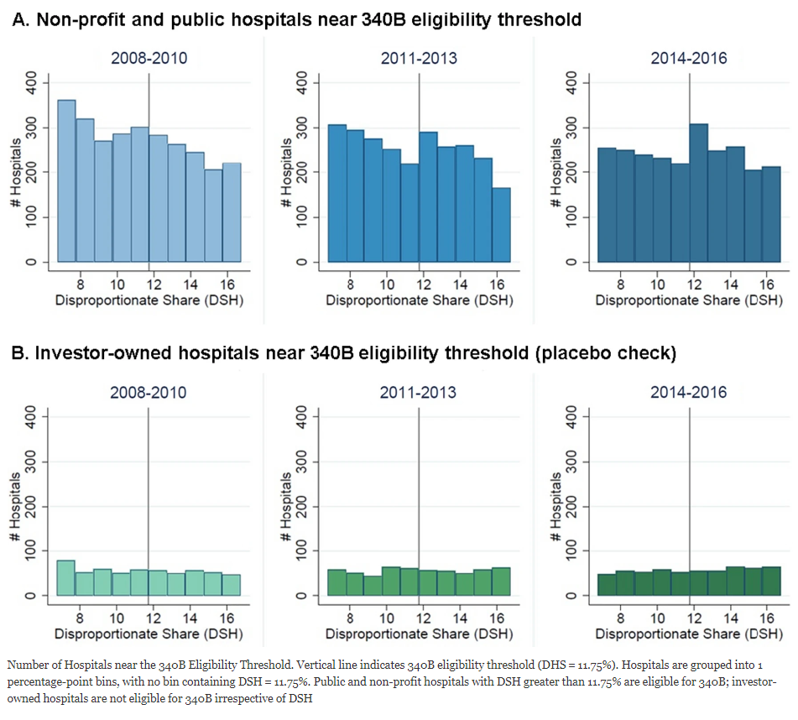

One key piece of evidence DiGriogio cites is a paper by Mulligan et al. (2021). This study find strategic behavior among hospitals. Hospitals that recieve disproportionate share hospitals (DSH) payments are eligible for 340B if their DSH adjustment–a measure that identifies hospitals that treat a disproportionate share of low income Medicare or Medicaid patients–is above 11.75%. Mulligan and co-authors used data from Healthcare Cost Report Information System (HCRIS) to examine if hospitals are adjusting their DSH to gain eligibility. Because investor-owned hospitals are not eliigble for 340B, one would expect no strategic behavior from these hospitals. The authors use a McCrary density tests to assess whether the observed difference in density of hospitals just below and above the 11.75% threshold was significantly larger than what would be expected by chance alone. The authors find that:

In 2014–2016, the number of hospitals increases by 41% just above the 340B eligibility threshold. McCrary density tests found this increase to be statistically significant across a range of bandwidths in 2014–2016 (p < 0.01)…We found no comparable change among hospitals ineligible for the 340B program. These data are consistent with the hypothesis that some hospitals adjust their DSH to gain 340B eligibility.

You can read the full Mulligan et al. (2021) paper here.