That is the subtitle of an NBER working paper by Charles Gray, Abby E. Alpert & Neeraj Sood. The author examine recent mergers between pharmacy benefit managers (PBMs) and health insurers. On the one hand, integration may beneficial to consumers. It could: (i) improve operational efficiencies, and (ii) better align PBM incentives with those of the health plan (e.g., better accounting for medical costs offsets). However, the authors also note that there are two pathways through which the integration could leave consumers worse off: (i) input foreclosure and (ii) customer foreclosure.

Input foreclosure occurs when a PBM owned by an insurer increases the costs or reduces the quality of its services provided to insurers who compete with its parent insurer. For example, the PBM could pass through a larger share of manufacturer rebates to its parent insurer than it passes through to rival insurers. The degree of input foreclosure depends on the level of competition in the PBM market. If PBM markets have many competitors, then input foreclosure is less likely as rival health plans experiencing input foreclosure can switch to one of many standalone PBMs. However, if PBM markets are highly concentrated then input foreclosure is more likely as rival plans have limited options to switch to another PBM. Customer foreclosure, by contrast, occurs when the downstream firm of a merged entity no longer purchases inputs from its upstream competitors. For instance, when an insurer and PBM consolidate, the insurer’s health plans will always use services from its own PBM, thus reducing the potential number of clients for standalone PBMs. The reduction in the potential customer base could ultimately lead standalone PBMs to exit the market which would further increase the concentration of PBMs.

The authors use a number of different datasets including (i) publicly available CMS PDP Landscape file datasets on Medicare Part D plan characteristics and enrollment (2010-2018), (ii) CMS Part D Contract and Enrollment Data contain information on plan’s annual enrollment, and (iii) Decision Resources Group

(DRG) Managed Market Surveyor (MMS) (2010-2018) to identify which PBM each Part D plan uses.

Then, they perform a difference-in-differences (DD) analysis looking at the Part D market before and after a large 2015 insurer-PBM merger (UnitedHealth-Catamaran), which the authors claim “eliminated the last significant standalone PBM and shifted more insurers into contracts with vertically integrated PBMs.” The pre-post analysis compares changes in premiums for vertically integrated plans (i.e., plan owns their own PBM) compared to non-vertically integrated plans.

Using this approach, the authors find that:

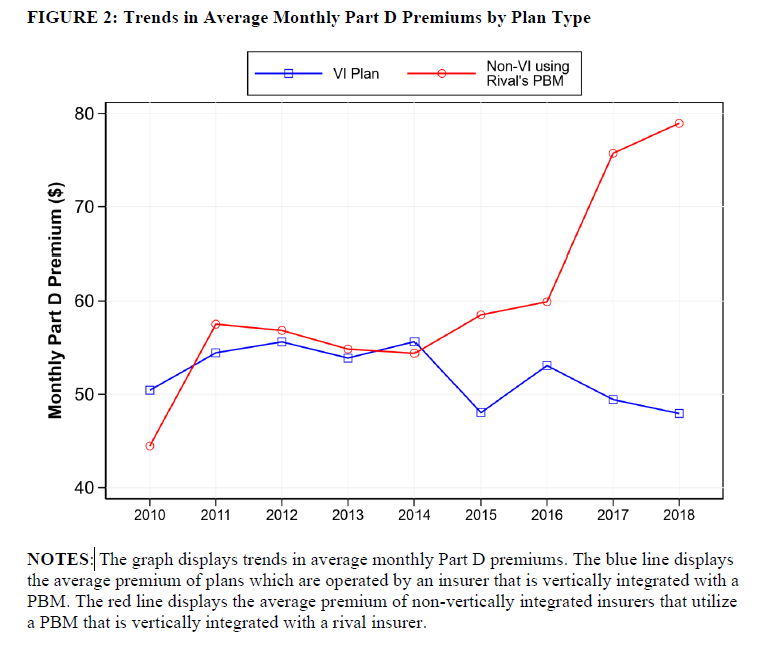

…nonvertically insurers experienced premium increases of 36% when compared to vertically integrated insurers. These findings are consistent with vertically integrated PBMs engaging in input foreclosure. Specifically, a vertically integrated PBM had a larger incentive to raise costs for rivals when those rivals lost the ability to substitute to a standalone PBM.

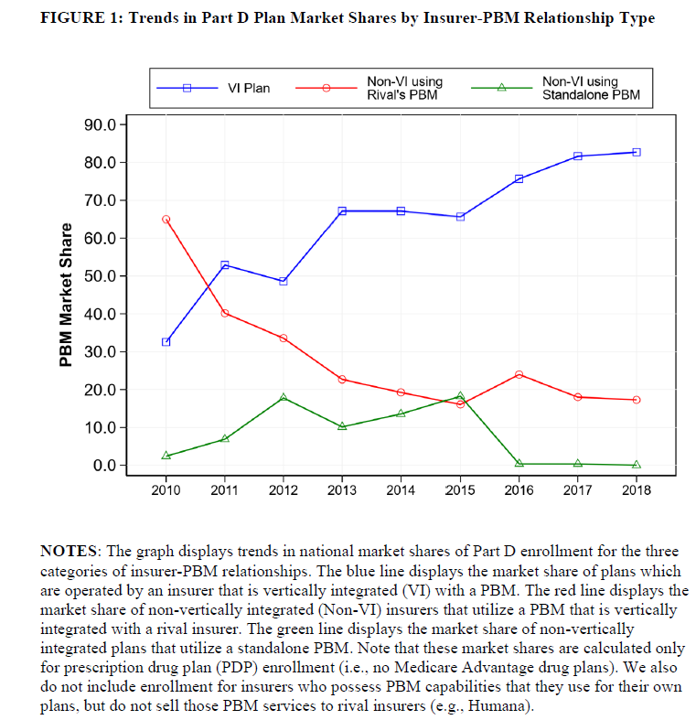

The figures below show that (i) vertically integrated plans began to dominate the market and (ii) prices for non-vertically integrated plans increased more than for vertically integrated plans.