The Academy of Managed Care Pharmacy (AMCP) held an interesting webinar titled “5 Years of ICER – Insights and Impact on Payers“. Some highlights form the presentation.

Most relevant information

Jeremy Lee from MedImpact–a pharmacy benefits manager (PBM)–noted that their Pharmacy and Therapeutics (P&T) committee used four key pieces of evidence when making coverage and utilization management decisions. These include: (i) the drug label, (ii) the results form the clinical trial, (iii) physician or specialty society guidelines, and (iv) expert opinion. When an ICER report becomes availabe, Dr. Lee noted that they received five additional pieces of information: (i) value benchmark, (ii) patient perspectives, (iii) contextual considerations, (iv) current coverage policies [for existing treatments] and (v) utilization management recommendations. Dr. Lee noted that while the value benchmark in terms of cost per QALY gets the most press, it actually was not frequently used by MedImpact’s P&T committees.

The panelists did not appear to be able to distinguish between the payer and societal perspective or largely ignored the societal perspective. The exception was for organizations that relied heavily on ICER’s cost-per-QALY estimates, but to date this group makes up a minority of decision-makers.

Timing of information used

Dr. Lee noted that that the draft evidence report and sometimes that Evidence report is most frequently used. While ICER aims to have the final report completed by the FDA approval date, Dr. Lee noted that the P&T committee typically evaluate drugs months prior to launch. Most of the presenters noted that the Report-at-a-Glance and ICER’s response to public comments were the most frequently used ICER outputs.

ICER reports vs. manufacturer dossiers

Allen Lising from FormularyDecisions noted that 79% of health care decision-makers that used ICER reports also looked at manufacturer dossiers; 46.5% of decision-makers who looked at dossiers also examined ICER reports. These pieces of evidence are seen as complementary.

Use of ICER reviews in decision-making

All three presenters notes that ICER reports are considered by health care decision-makers to be “secondary” data source which are used to validate their own internal assessments. Be that as it may, Linnea Tennant from Xcenda noted that in their survey 50 health care decision-makers, 68% of respondents had made a change in coverage based on an ICER report. The most common changes were commonly implementing a prior authorization (34%) or moving a drug to a lower (26%) or higher (24%) tier. Overall, most respondents to Dr. Tennant’s survey found ICER’s impact on decision-making somewhat impactful (58%) whereas 22% found the reports not at all/not very impactful and 20% thought ICER reports were very/extremely impactful on decision-making. According to Dr. Lee, although few people are using ICER’s value-based price as a hard benchmark, the ICER reports are being used to help PBMs craft the language used for their prior authorization criteria.

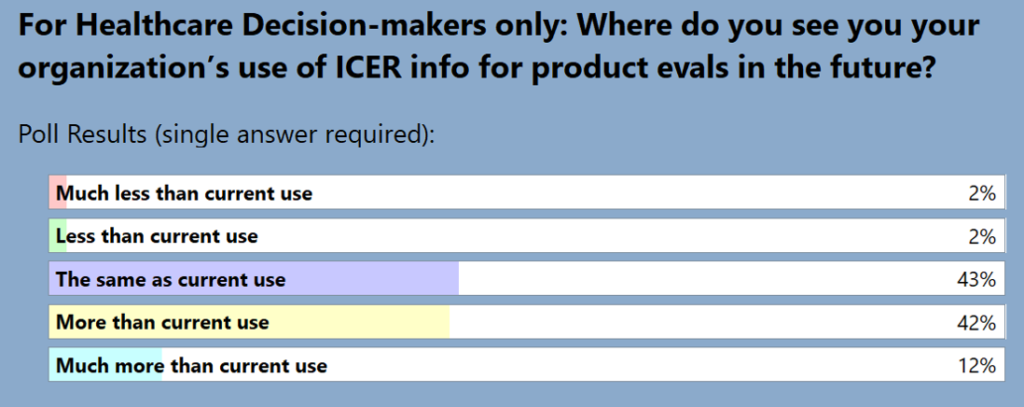

Among the health care decision-makers in the audience during the AMCP presentation, 54% believed ICER use will increase in the future, only 4% thought the use of ICER reports would decrease.

ICER limitations

Many decision-makers critiqued ICER for being a “black box” where one could not change inputs or assumptions. For hospitals and integrated delivery networks (IDNs), the ICER models may not be as relevant as the ICER models are typically made from the payer rather than the IDN perspective. The Innovation and Value Initiative (IVI) does have interactive models; ICER is starting to follow their lead by creating interactive models as part of their ICER Analytics platform.