The Government Accountability Office (GAO) last week published a report evaluating the Merit-based

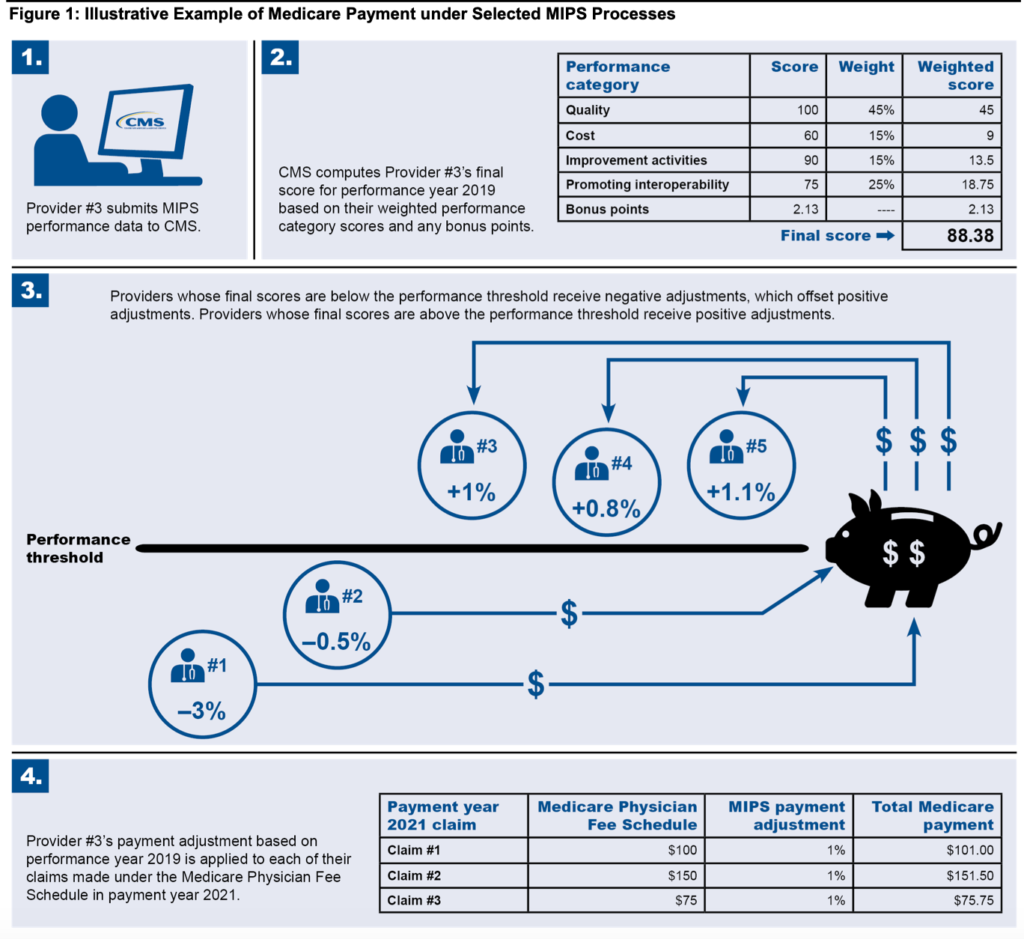

Incentive Payment System (MIPS). MIPS is an approach for CMS to pay physicians caring for Medicare beneficiaries based not just on volume but on value. MIPS evaluates provider value along four dimensions: (1) quality, (2) improvement activities, (3) promoting interoperability, and (4) cost. Below I summarize the report including background on the MIPS program, the results of the GAO evaluation of MIPS scores and bonus payments, and summary of stakeholder feedback.

MIPS PROGRAM BACKGROUND

- Exemptions. Some providers can be exempt from MIPS, typically if they have smaller practices. This is for two reasons: first the burden of MIPS reporting is more burdensome to small providers (due to economies of scale) and because smaller sample sizes mean that quality measures are less reliable. Physicians can be exempt from MIPS if they do not meet all of the following 3 criteria: (i) billed more than $90,000 for Part B services (ii) seen more than 200 Part B patients, and (iii) rendered more than 200 covered professional services to Part B patients.

- Individuals vs. groups. Physicians can participate in MIPS either as individual physicians or as a group practice. The unit of observation for the group practice is the Tax Identification Number or TIN. Since 2018, individual physicians can also participate as “virtual groups” if they want to pool their scores, but operate as separate TINs. This increases the sample sizes and makes quality measures less volatile on a year-to-year basis.

- Alternative Payment Models. Some physicians also participate in alternative payment models (APM) such as the Medicare Shared Savings Program (MSSP). Providers that are part of an APM entity may be collectively scored as an APM entity group and payment adjustments may occur based on the APM rules.

- Performance Scores

- Quality measures. Physicians are required to select at least 6 quality measures related to the care they provided to their patients during the year. Some quality measures are selected from pre-determined specialty list, but physicians get to choose the 6 measures over which they are evaluated.

- Improvement activities. These are activities the practices must engage in to improve the practice. Examples include completing CDC’s antibiotic stewardship course.

- Interoperability. This requirement relates to promiting patient engagement and insuring that electronic health records are certified and that the physicians systems are capable of e-prescribing.

- Cost. Cost is calculated based on the total cost of care for all of the physician’s attributed patients based on Medicare Part A and B claims.

- Bonus points. Providers can get bonus points if they have “complex” patients based on the share of patients who are dual eligible and there is a “small practice bonus” for practices with 15 or fewer providers who submit at least 1 quality measure.

- Payments. Practices with higher scores get bonus payments and those with lower scores receive penalties. The payments are set in a budget neutral fashion so that (outside of the costs for CMS to administer the MIPS program) there is no net impact of these payments on the CMS budget. The maximum negative payment is -9%; the maximum positive payment is set to ensure that the program remains budget neutral in a given year. In 2021, the range was -9% to +9%.

RESULTS OF GAO MIPS ANALYSIS

How did Medicare physicians fare on the MIPS program? GAO writes:

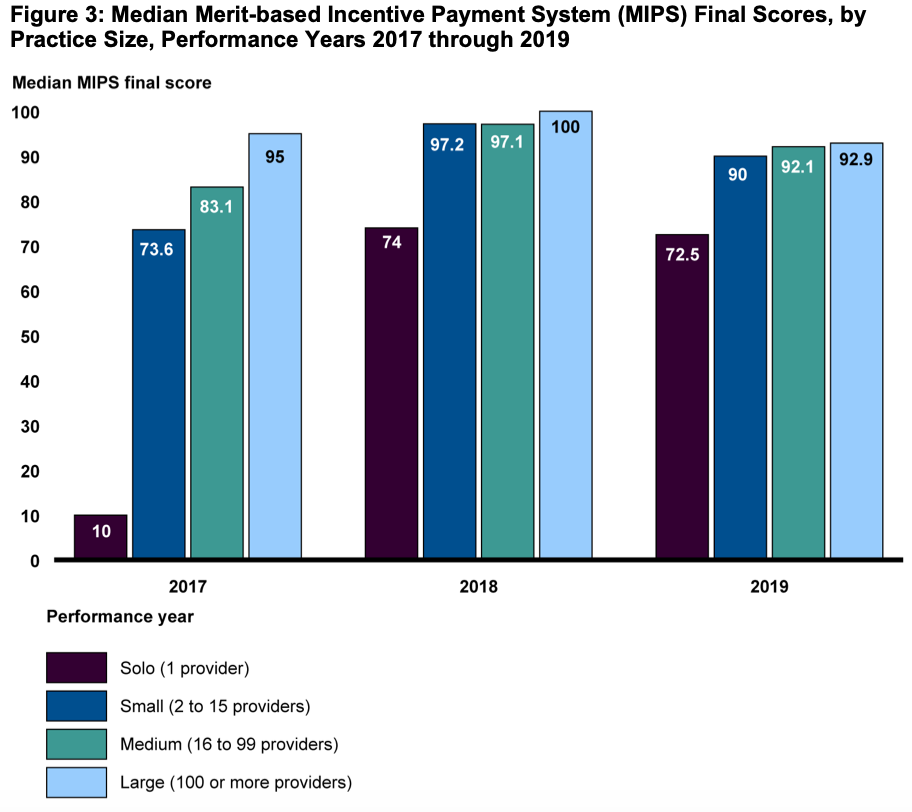

… MIPS final scores were generally high from 2017 through 2019, with most MIPS-eligible providers qualifying for a positive payment adjustment. Across the 3 years, median final scores ranged from about 89.7 to 99.6 (out of a possible 100)—well above the performance threshold (see fig. 2).26 At least 93 percent of providers qualified for a positive payment adjustment in any year, and no more than 4.8 percent of providers qualified for a negative payment adjustment…

The maximum positive payment adjustment for any of performance years 2017 through 2019 resulted in relatively small increases in Medicare payments. For example, a provider with $90,000 in Medicare Physician Fee Schedule payments would only see an increase of $1,692 in payment year 2019 if they received the maximum positive adjustment of 1.88 percent based on their performance in 2017.

STAKEHOLDER FEEDBACK

Unsurprisingly, provider groups welcomed more flexibility. For instance, some provider groups received exemptions from reporting along certain dimensions (e.g., radiologists and pathologists did not have to report “promoting interoperability”). Smaller provider groups also appreciated the “small practice bonus” and the low volume threshold which exempted the smallest providers from MIPS participation.

Key critiques include: that feedback was not timely or meaningful to many providers.

- Feedback is not timely. Providers have to submit prior year data by the end of March and then providers do not get feedback from the CMS analysis until July. From the provider perspective, this is already more than 6 months into the next year. From CMS’s perspective, speeding up the data submission deadlines is likely to receive pushback from providers about the undue burden of data submission.

- Feedback is not meaningful. Practices are more interested in their performance relative to their peers in the same specialty and geographic areas and asked CMS to provide those statistics. Also, many providers–especially larger practices–may be choosing quality measures strategically to maximize their payments. A number of stakeholders also noted that the measures of interest were not very clinically meaningful. Many believe that MIPS leads to providers prioritizing reporting over quality of care, since it is (financially) better to choose metrics where the practice is already performing well rather than ones where the practice would need to improve.

- Robustness of metrics. Some metrics do not happen frequently enough to be precisely measured. CMS faces the challenge that the more specific the measure is, the more relevant it will be to certain physicians; however, the more specific the measure becomes, the smaller sample size and less robust quality metric becomes.

- ROI. Practice return on investment from MIPS participation was low. The payment bonuses were fairly low, but the administrative burden and cost to the practice was fairly high.

MIPS VALUE PATHWAY (MVP)

To address some challenges, CMS’s 2022 proposed rule plans to implement the MIPS Value Pathway (MVP) in performance year 2023.

If the rule is finalized as proposed, MVPs will allow providers the option of reporting on a group of activities and measures from the four MIPS performance categories that are relevant to a specific specialty, medical condition, or episode of care.39 Under the proposal, in 2023, providers may register to report data and receive feedback on one of seven MVPs related to the following clinical topics: (1) anesthesia, (2) chronic disease management, (3) emergency medicine, (4) heart disease, (5) lower extremity joint repair, (6) rheumatology, and (7) stroke

In addition, CMS proposes to allow subgroup reporting for MVPs..[which] would allow a specialty within a large multi-specialty group to register as a subgroup and receive more clinically meaningful feedback on its measures and activities in the quality, improvement activities, and cost performance categories.

The MVP framework would also standardize performance measurement across selected specialties, medical conditions, or episodes of care. A more cohesive set of measures can help reduce the amount of “gaming” the system that providers can do.