That is the summary takeaway I had form reviewing the 91 page CMS guidance on the Inflation Reduction Act (IRA) maximum fair price (MFP) negotiation released about 10 days ago. Below, I summarize some of the key findings.

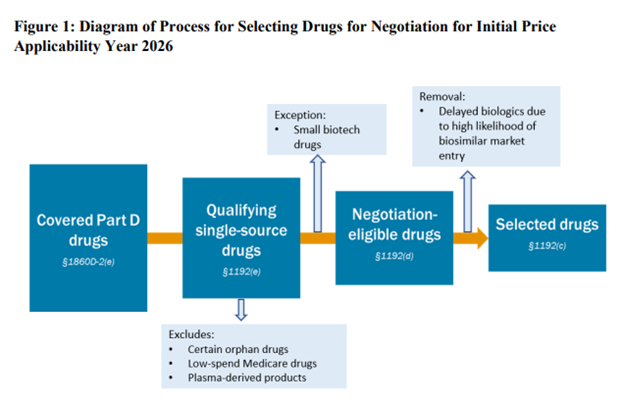

SELECTING DRUG FOR PRICE NEGOTIATION

Unsurprisingly, CMS is looking for the highest cost drugs among the 10 to be eligible for the initial IRA price negotiation. Specifically, FDA is looking for small molecule products with no generics that have been on the market for 7 years (so they can negotiate at year 9) or biologic drugs with no biosimilars that have been on the market for 11 years (so they can negotiation in year 13). The highest cost drugs are those that have among the “50 qualifying single source drugs with the highest Total Expenditures under Part D”. These are identified using Part D prescription drug event (PDE) data.

There are a number of exclusions for drugs eligible for negotiation.

- Orphan drugs: CMS will not exclude all orphan drugs from price negotiation. Many drugs have an orphan indication but also another indication for a non-orphan disease. “CMS will exclude a drug or biological product that is designated as a drug for only one rare disease or condition under section 526 of the FD&C Act and that is approved for only an indication (or indications) for such disease or condition”

- Low-spending Medicare drugs. Drugs where combined Medicare Parts B and D spending are less than $200m will not be negotiated. Note that this figure is not inflation indexed. If not updated over time, this exclusion will apply to fewer and fewer drugs.

- Plasma derived products. These include any product derived from human whole blood or plasma.

- Small biotech. CMS is asking manufacturers to submit information about its products in order for the drug to be considered for the exception under the small biotech rule. To reach the exception, CMS requires that (i) manufacturers sales (based on PDE data) to be <1% of total Part D expenditures and (ii) the drug under consideration to be “negotiation eligible” for MFP makes up ≥80% of manufacturer’s revenue from Part D expenditures. If both of these criteria are met, the drug would qualify for a small biotech exception.

- Biosimilar entry. The manufacturer of a biosimilar may request that a one year delay (“Initial Delay Request”) of a biosimilar is soon to enter. The biosimilar manufacturer an request a second initial price applicability year (“Additional Delay Request”) as well. Thus, the total potential delay is 2 years. The biosimilar manufacturer cannot be the same company as the reference drug (i.e., brand) manufacturer.

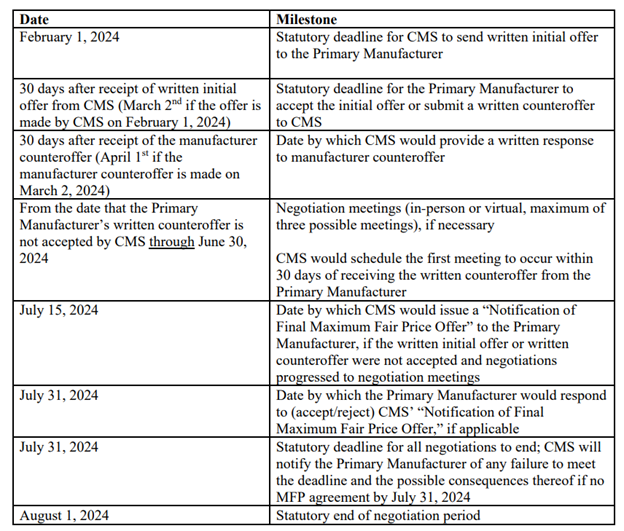

DRUG NEGOTIATION PROCESS

There are a number of factors CMS can consider as part of the negotiation. These include non-FAMP price, comparative effectiveness of the selected drug and its therapeutic alternatives

- Medical advance: The extent to which the selected drug represents a therapeutic advance compared to existing therapeutic alternatives for the selected drug and the costs of such existing therapeutic alternatives;

- Therapeutic alternatives: FDA-approved prescribing information for the selected drug and its therapeutic alternatives;

- Comparative effectiveness. This includes the effects of the selected drug and its therapeutic alternatives on specific populations (including individuals with disabilities, the elderly, the terminally ill, children, and other patient populations, herein referred to as “specific populations”)

- Unmet medical need. The extent to which the selected drug and the therapeutic alternatives to the drug address unmet medical needs for a condition for which treatment or diagnosis is not addressed adequately by available therapy.

CMS explicitly states that it will not use QALYs as part of the negotiation stating that information that:

“treats extending the life of individuals in these populations as of lower value, for example certain uses of quality-adjusted life-years (QALYs), will not be used in the negotiation process. In instances where a study uses QALYs in a life-extension context but has clearly separated this use of QALYs from other evidence in the report (e.g., clinical effectiveness, risks, harms, etc.) that is relevant to the factors listed in section 1194(e)(2) of the Act, CMS intends to consider such separate evidence”

CMS is considering a variety of potential paradigms for setting drug prices including:

- Part D net price(s) and/or the ASP(s) of therapeutic alternative(s), if any, to the selected drug,

- Unit cost of production and distribution for the selected drug,

- Ceiling price for the selected drug

- A domestic reference price for the selected drug (e.g., the Federal Supply Schedule price),

- A “fair profit” price for the selected drug based on whether research and development costs have been recouped and margin on unit cost of production and distribution

However, they state that:

“After considering these options, CMS intends to use the Part D net price(s) (“net price(s)”) and/or ASP(s) of therapeutic alternative(s) for the selected drug, as applicable, as the starting point for developing the MFP initial offer unless this net price or ASP is greater than the statutory ceiling”

They continue:

“If there is one therapeutic alternative for the selected drug, CMS intends to use the net price or ASP, as applicable, of the therapeutic alternative as the starting point to develop CMS’ initial offer for the MFP if it is lower than the ceiling. If there are multiple therapeutic alternatives, CMS intends to consider the range of net prices and/or ASPs as well as the utilization of each therapeutic alternative to determine the starting point within that range. If the selected drug has no therapeutic alternative, if the price of the therapeutic alternatives identified is above the statutory ceiling for the MFP (described in section 60.2 of this memorandum), or if there is a single therapeutic alternative with a price above the statutory ceiling, then CMS intends to determine the starting point for the initial offer based on the Federal Supply Schedule33 (FSS) or “Big Four Agency”34 price (“Big Four price”).”

However, this initial price will be adjusted based a number of factors.

- Clinical benefit. “Once the starting point for the initial offer has been established and evidence on clinical benefit has been considered, CMS intends to adjust the starting point for the initial offer based on the review of the clinical benefit (this adjusted price is referred to herein as the “preliminary price”)”

- R&D costs. “if a Primary Manufacturer has not recouped its research and development costs, CMS could consider adjusting the preliminary”

- Unit prices: “CMS may consider adjusting the preliminary price downward if the unit cost of production and distribution is lower than the preliminary price, or upward if the preliminary price is close to the unit costs of production and distribution”

- Prior federal support. “CMS may consider adjusting the preliminary price downward if funding for the discovery and development of the drug was received from Federal sources”

- Patents. “CMS intends to consider the length of the available patents and exclusivities before the selected drug may no longer be single source. For example, if the selected drug has patents and exclusivities that will last for a number of years, CMS may consider adjusting the preliminary price downward

- Commercial prices. “If the average commercial net price is lower than the preliminary price, CMS may consider adjusting the preliminary price downward”

Once a drug has a generic competitor or biosimilar, the product is no longer including in the MFP negotiation in following years.

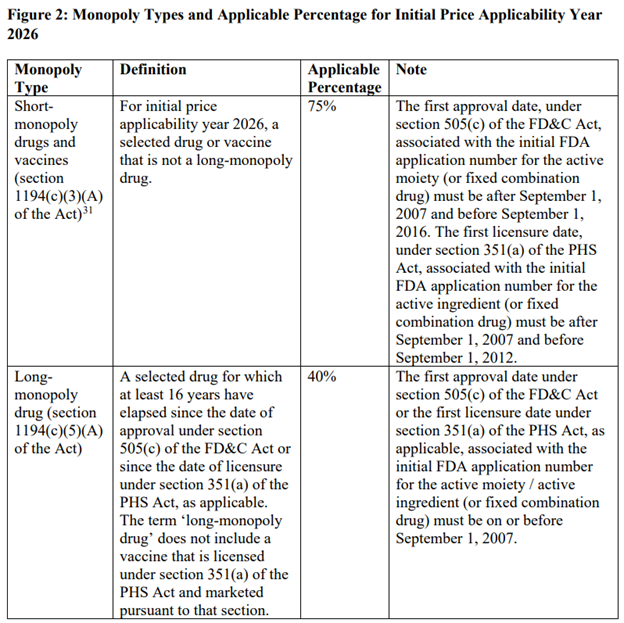

MONOPOLY PROVISIONS

The price reductions from the maximum fair price vary based on whether a drug is considered short-term (12 years or less), long-term (more than 16 years) or somewhere in between. This is described in the table below.

RELEVANT DATES

INFORMATION CMS WILL REQUEST FROM MANUFACTURERS

Information that CMS is requesting of drug manufacturers under the IRA drug price negotiation are:

- Drug prices beyond that collected by Medicare

- Non-Federal average manufacturer (Non-FAMP) price: Section 1194(c)(6) of the Act defines “average non-Federal average manufacturer price” as the average of the non-FAMP (as defined in section 8126(h)(5) of title 38 of the U.S. Code) for the four calendar quarters of the year involved.

- Non-FAMP unit: Non-FAMP unit is the package unit as described in section 8126(h)(6) of title 38 of the U.S. Code.

- Research and development (R&D):

- Basic Pre-Clinical Research Costs

- Post-Investigational New Drug (IND) Application Costs

- Completed U.S. Food and Drug Administration (FDA)-Required Phase IV Trials

- Post-Marketing Trials

- Abandoned and Failed Drug Costs

- All Other R&D Cost

- Recoupment: Global, Total Lifetime Net Revenue for the Selected Drug. Net revenue describes revenue less discounts, chargebacks and rebates.

- Prior federal financial support. This includes tax credits, direct financial support, grants or contracts, and any other funds provided by the 88 federal government that support discovery, research, and/or development related to the selected drug.

- Patent information. All pending and approved patent applications, including expired and non-expired patents

- Market data and sales volume

- Wholesale acquisition cost (WAC) unit price

- Average manufacturer price (AMP) unit

- 340B prices. These include 340B ceiling price and 340B prime vendor program (PVP) price

- Other federal government prices. These include: (i) Medicaid best price, (ii) Federal supply schedule (FSS) price, and (iii) Big Four price [i.e., price for Department of Veterans Affairs (VA), DoD, the Public Health Service, and the Coast Guard]

- U.S. commercial average net unit price (with and without patient assistance programs)

- Manufacturer average net unit price to Part D Plan sponsors (with and without patient assistance programs)

- Revenue. This includes gross revenue, net revenue and net revenue without patient assistance programs

- Quarterly US unit volume

CMS also requires manufacturers to assume a 8.1% cost of capital.