That is the title of an article by Cascaldi-Garcia et al. (2023) in the Journal of Economic Literature. I summarize some of the key findings below.

Definitions:

- Risk: Applies to situations in which the outcome is unknown to decision makers, but the probability distribution governing the outcome is known”

- Volatility. Often used synonymously with risk, volatility is a statistical measure of the variation in observed outcomes

- Uncertainty. Characterized by both an unknown outcome and an unknown probability distribution

Note the key difference between risk and uncertainty. Citing Caballero 2010, the article notes:

When agents realize that their assumptions about risk are no longer valid and conditions of uncertainty apply, their fear about unexpected losses can ravage financial markets.

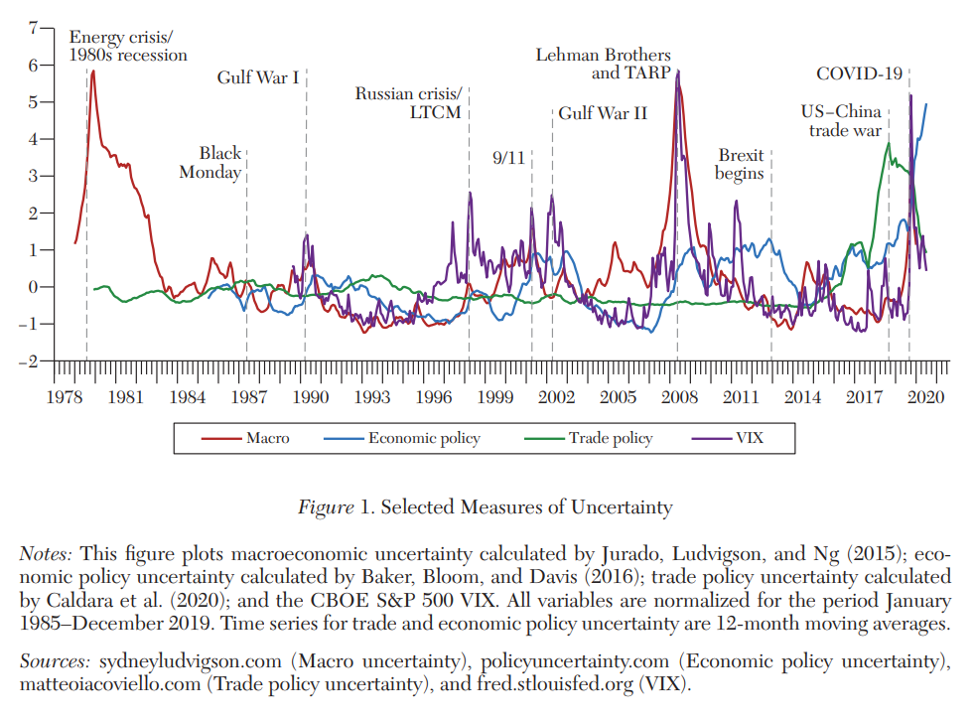

Below I summarize four different ways to measure uncertainty: (i) news-based, (ii) survey-based, (iii) asset-based, and (iv) econometric.

News-based measures.

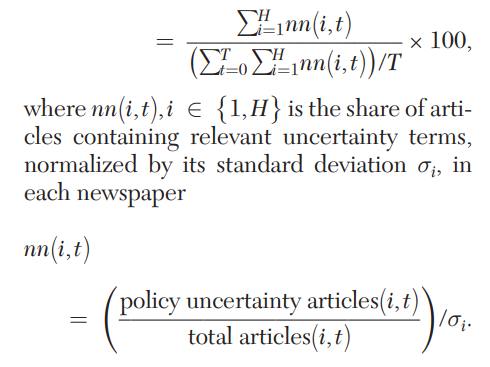

This approach uses mentions of different types of risk and newspapers and other media as a quantitative measure of uncertainty. Examples include economic policy uncertainty (EPU) index developed by Baker, Bloom, and Davis (2016), index of monetary policy uncertainty (MPU) developed by Husted, Rogers and Sun (2020), and a trade policies uncertainty (TPU) index developed by Caldara et al. (2020). Ahir, Bloom and Furceri (2022) created a World Uncertainty Index (WUI), which is a GDP-weighted average of country-level uncertainty indexes.

Of particular interest, the Baker, Bloom and David article constructed “…a health-care EPU index by searching for articles that discuss rising EPU as well as terms such as ‘health care,’ ‘Medicaid,’ ‘Medicare,’ ‘health insurance,’ ‘affordable care act,’ and ‘medical insurance reform’.”

The approach is useful as it can look at future risk—especially geopolitical—but is likely biased towards the perception of editorship at major media companies. Further, causation may be problematic as the suggestion of more (or less) risk at major media entities may influence public perceptions.

Survey-based approach.

This approach asks individuals to consider a variety of different scenarios and place a probability associated with each. Then one can measure uncertainty based on the standard deviation of the responses in the survey. Ex-ante measures typically ask respondents about point predictions (e.g., mean expectation) of future events (e.g., inflation, GDP, sales growth) at a future time period. Aggregating individual responses allows for the estimation of a measure of the dispersion across respondents regarding the point prediction. This calculates uncertainty across individuals. Other surveys also ask individuals about the probability of certain events occurring and thus can get within individual uncertainty as well. Ex-post measures of uncertainty compared deviations of recent economic data releases from consensus expectations.

Like all metrics of uncertainty, these have both pros and cons.

“…survey-based measures allow precision concerning the sector in which the uncertainty is located (e.g., firms, households, or traders), the economic measure (e.g., employment, expenditures, policy), and the horizon over which the uncertainty prevails. However, these measures tend to be available at a lower frequency and hence possibly stale relative to, say, news-based or market-based measures.”

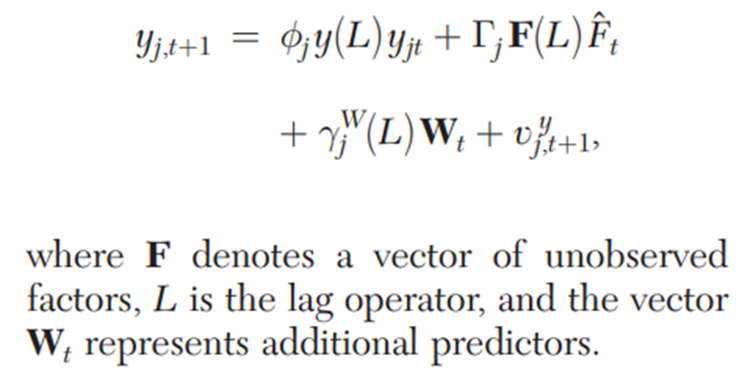

Econometric approaches.

Econometric approaches use data estimation techniques and equate uncertainty with lack of predictability of aggregate activity. One measure of uncertainty is value-at-risk (VaR), which is defined as a threshold such that the probability of a specific outcome not exceeding this threshold is equal to a desired level. The probabilities are often computed based on quantile regressions. More broadly:

“Compared to alternative measures of uncertainty, econometric-based measures have the advantage of being directly grounded in—and guided by—statistical inference, and they reflect the “big picture” in the same sense as news-based measures. However, econometric-based measures are available at lower frequencies and may be significantly different when estimated on ex post revised data versus real-time data” The article cites a paper by Jurado, Ludvigson, and Ng (2015), which uses a factor-augmented forecasting model as follows:

Asset-based measures

Historical volatility in asset returns and interest rates is one way to measure. Asset-based measures tend to reflect the view of market participants actively trading in one particular asset market and thus may only be pricing in risk that impacts that particular asset.

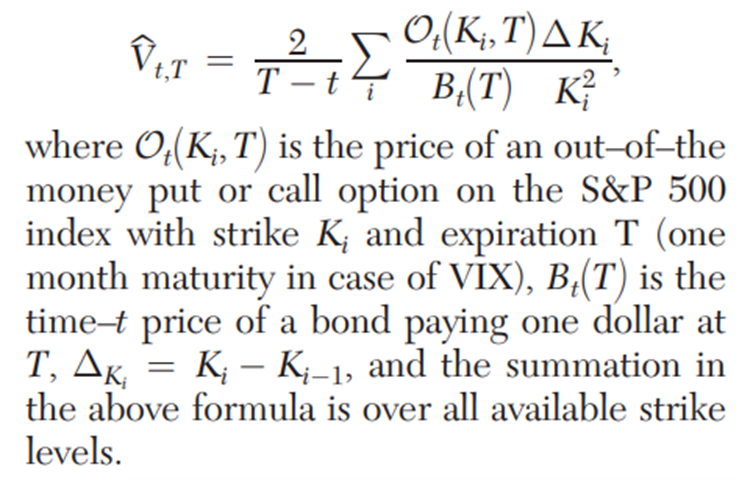

“One widely used uncertainty measure is the VIX, the Chicago Board of Options Exchange’s (CBOE) Volatility Index, an index calculated using equity index options and measuring market participants’ expectations for the volatility of the S&P 500 index over the coming 30 days.”

The formula for VIX is as follows:

Another measure is realized volatility (RV), which is defined as the scaled sum of squared daily returns. RV is considered to be an improvement over generalized autoregressive conditional heteroskedasticity (GARCH). As asset based measures often have large sample size and are frequently measured, one can readily capture higher order moments as well (e.g., skewness and kurtosis).

Conclusion

The review paper unfortunately does not touch much on health—except as how COVID-19 impacted the global economy and the health care EPU by Baker et al.—but nevertheless it does provide a healthful overview of risk-related metrics. These empirical approaches for measuring risk using various sources (news, surveys, econometric approaches, and asset prices)–could readily be adapted for health care purposes, in particular the news and survey-based measures.