Samsung Bioepis has a Biosimilar Market Report for Q2 2024. Some key highlights:

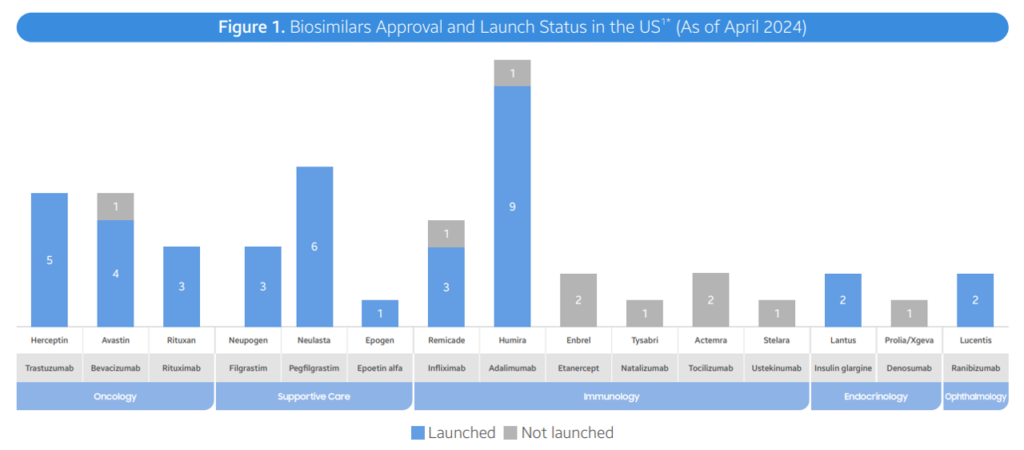

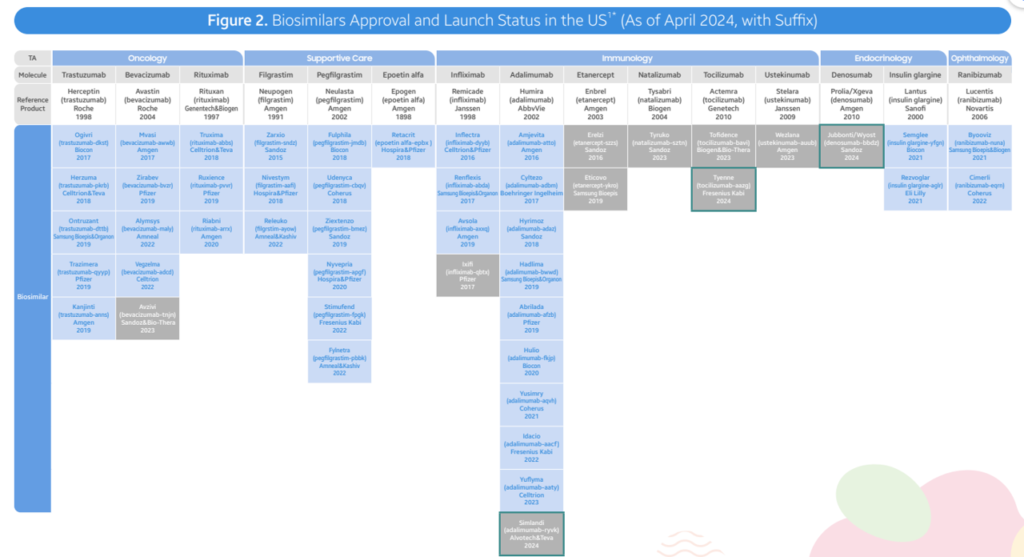

- As of April 2024, the FDA has approved a total of 48 biosimilars across 15 unique biological molecules. Of the 48 approvals, 38 biosimilars have launched in the US market. In Q2 2024, 3 new biosimilars were approved in the US (Simlandi for Humira (adalimumab); Jubbonti/Wyost for Prolia/Xgeva (denosumab); Tyenne for Actemra (tocilizumab))

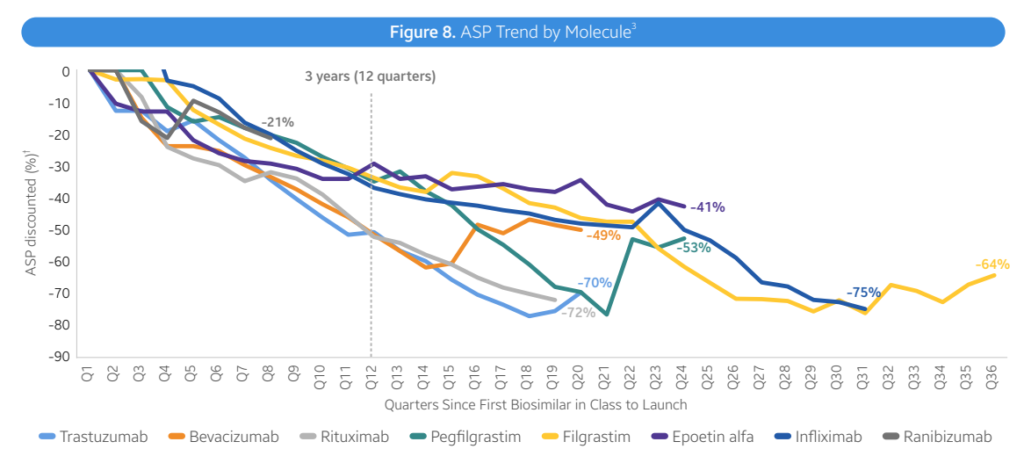

- Moderate discounts. Overall, biosimilars are leading to lower prices, largely through rebates rather than list price. However, prices fell by 41% within 3 years with a lot of variability across therapeutic areas.

- In oncology, biosimilars wholesale acquisition cost (WAC) prices were 10%-25% lower than reference products. In supportive care,

- For supportive care, WAC prices of biosimilars for pegfilgrastim and epoetin alfa are 20-60% lower reference, but average sales prices (ASP) for the reference products has fallen to match ASP for biosimilars in an effort to retain market share.

- Immunology (Infliximab). Infliximab biosimilars launched with progressively lower WACs, ranging from -19% to -59% in discounts. Biosimilar competition has led to ASP prices 75-90% lower than the reference product WAC

- Immunology (Humira). Adalimumab (Humira) biosimilars have taken different approaches. Two biosimilars have used lower WAC prices (85% discounts). Most Infliximab biosimilars launched with progressively lower WACs, ranging from -19% to -59% in discounts. Biosimilar competition has led to ASP prices 75-90% lower than the reference product WAC

- Opthalmology. Recent ranibizumab (Lucentis) biosimilar launches have already led to 30-40% lower reference product ASP costs. Six other biosimilars have used an approach with similar WAC prices to branded Humira but with large rebates the reduce prices by 55%-90% of the reference product.

- Diabetes. Biosimilars for Lantus (insulin glargin) have also used a mixed approach where some products have lower WAC and others have similar WAC but lower prices due to rebates.

- Biosimilar uptake varies by molecule. Three years post-launch, biosimilar uptake for bevacizumab, trastuzumab, pegfilgrastm and rituximab were all >50%. For other drugs such as insulin glargine, epoetin alfa and infliximab, market shares were all <50% at year 3. In general, market share rises substantially over time, however, in immunology Humira branded products still comprise 96% market share.

- Inflation Reduction Act. There are some provisions that are positive for biosimilars and others less so.

- Pro: Loss of manufacturer revenue from Medicare Drug Price Negotiation and Inflation Rebate may lead manufacturers to launch with higher list prices and/or reduce rebate rates in other therapeutic areas or lines of business (e.g. private insurance). Biosimilars may offer greater cost relief in those future markets. Additionally, the increased Medicare payment limit for biosimilars to ASP + 8% helps offset some of the losses that providers may incur when using cheaper ASP biosimilars on the medical benefit

- Con: Medicare Drug Price Negotiation will impose pricing pressure on the selected drugs and their associated competitors. In those markets (i.e. Enbrel, Stelara), the savings that biosimilars can offer to plans may be reduced, making step therapy through biosimilars a less attractive strategy for plan sponsors to implement. Moreover, reductions and caps in the Part D member cost sharing requirements, while a positive improvement for the overall affordability of Medicare beneficiaries, unintentionally reduces the financial incentive for members to switch to a biosimilar from an originator product

You can read the full deck here.