A policy paper by the HHS describing proposals to promote choice and competition in health care. Before getting into policy recommendations, however, it outlines how increased provider consolidation has lead to less choice.

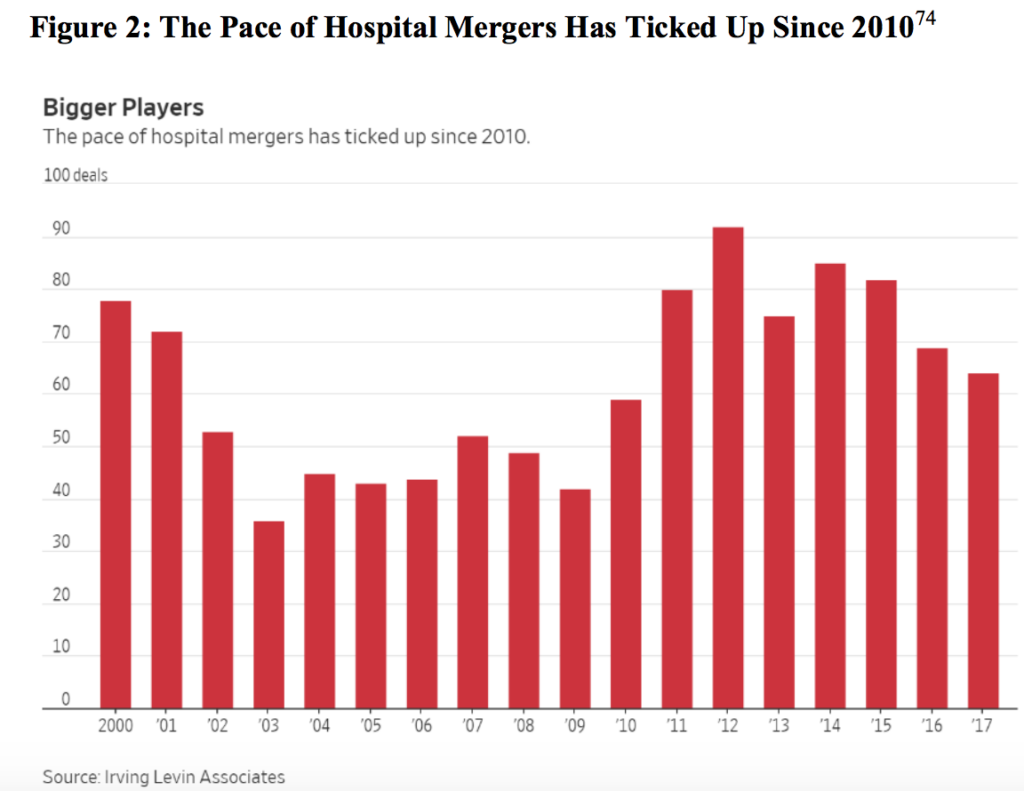

One recent study by Gaynor et al. …found that the mean HHI [Herfindahl-Hirschman Index] across MSAs in the inpatient hospital industry increased from 2,370 in 1987 to 3,261 in 2006—an increase of more than 900 points. It also found that most of this increase had occurred by the year 2000

Physicians also have been consolidating. While the trend is not a severe as in inpatient hospital care, it is happening, but market concentration does vary across specialties. One study found that:

…median two firm concentration ratios (CR2) across all

areas of 33 percent for primary care

services, but 58 percent for cardiology,

72 percent for oncology, 49 percent for

orthopedics, and 57 percent for

radiology. Similarly, it found a median

HHI of 761 for primary care services,

but 2,370 for cardiology, 3,606 for

oncology, 1,751 for orthopedics, and

2,190 for radiology.

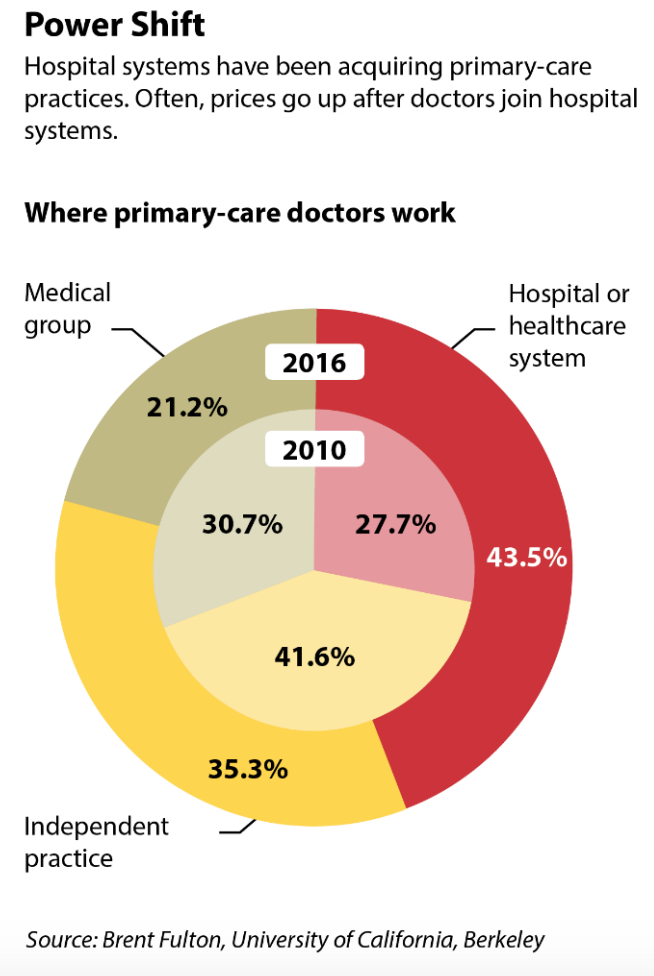

In particular, large hospital groups have been buying medical practices and more MDs are working for large hospital groups than ever before. Market concentration, however, not only varies across geography but also by physician specialty. One study found that:

…median two firm concentration ratios (CR2) across all areas of 33 percent for primary care

services, but 58 percent for cardiology, 72 percent for oncology, 49 percent for orthopedics, and 57 percent for radiology. Similarly, it found a median HHI of 761 for primary care services,

but 2,370 for cardiology, 3,606 for oncology, 1,751 for orthopedics, and 2,190 for radiology.

This is not surprising, especially the fact that oncology is leading the pack. Oncology was hit hard by changes in drug reimbursement and the cost of maintaining stock. Hospitals receive more favorable reimbursement for drugs delivered in an outpatient hospital unit. That’s a no-brainer. This is the obvious result of pressure from HMO market penetration and insurance industry consolidation. After losing the ability to balance bill Medicare patients, the only other option fro doctors is to opt-out of insurance altogether–an option only available in exclusive areas of the country with plenty of wealthy people willing to pay for “the best doctors.” The health insurance industry has done little enough to control prices. What rationale for their continued existence will they have if this trend continues?